In managed services contracts, we continue to draft up and get equitable agreement for a 3.0%-3.5% global COLA i.e., applicable to the managed services delivery model incl. the underlying global delivery location portfolio agreed by both parties. The expectation is that the above 3.0-3.5% should be explicitly stated as part of the fee assumptions but needs to be pre-baked into the Y1-Y5 ACV’s i.e., no fee changes during the initial contract term. This incentivizes / encourages the provider to offset COLA against automation-led benefits in the out years, staffing mix and on-offshore mix changes during the contract term etc.

Besides the managed services component, there is typically the project rate card i.e., T&M component in the pricing exhibits. Typically, COLA is applied starting Y3 of the deal & can have higher exposure than managed services COLA i.e., in the 3-5% range depending on skill sets. COLA is subject to the benchmarking clause i.e., if either party wishes to invoke the benchmarking clause to sense-check any significant rate/market changes if the contracted COLA is unacceptable by either party when the need arises

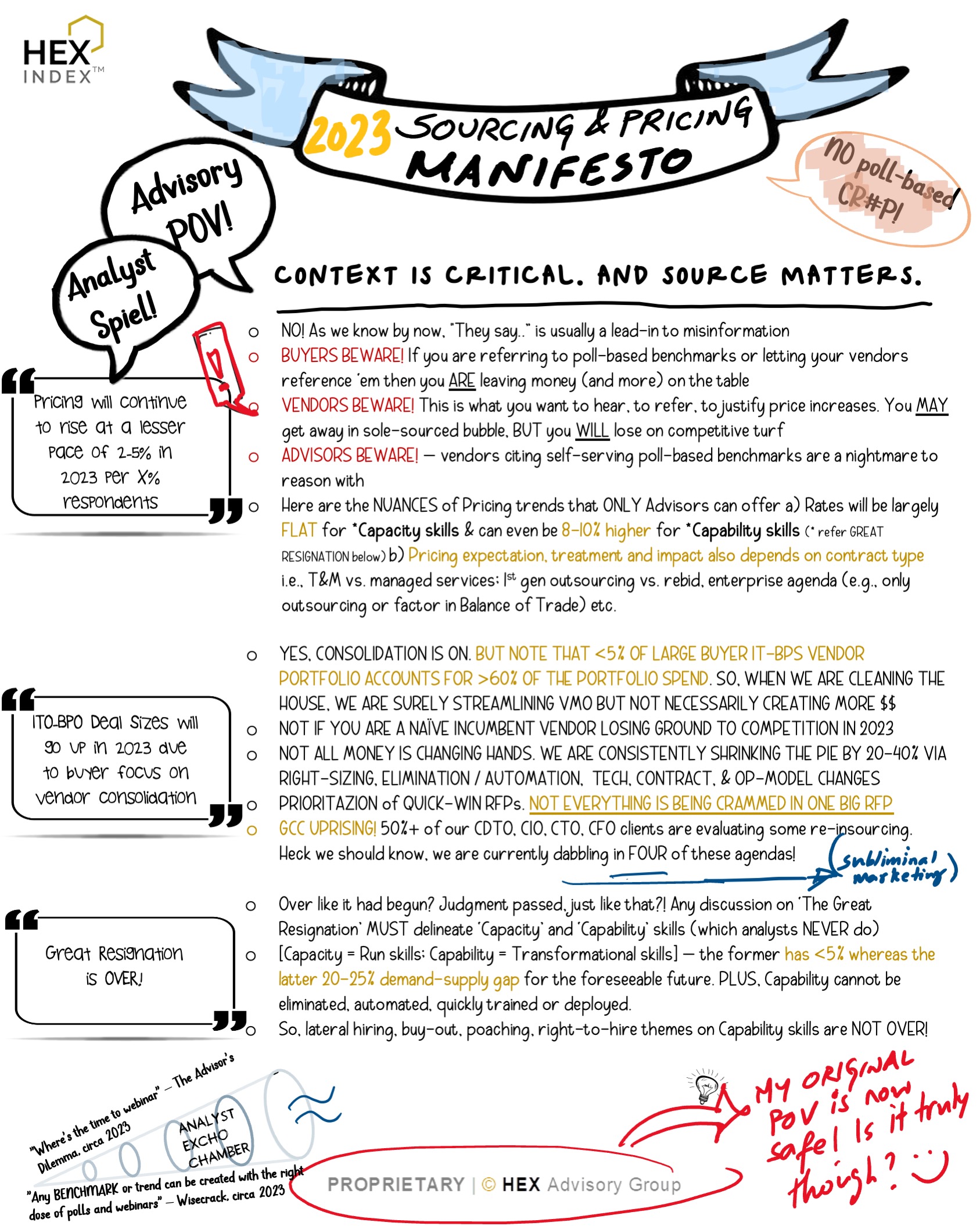

All providers are concerned about the wage inflation, which while real for experienced/lateral hires, needs to be contextualized in the scope of a typical IT-BPS managed services delivery solution. Fact is that the entry-level salaries have remained consistent for the last many years and the same is true even now. Plus, all providers are pushing their entry-level pool to Tier2/3/4 locations and colleges to keep this entry-level cost base consistent, and this is where most providers expect to build 70-80% of their incremental seat capacity esp. with the remote model – most providers have alluded to this in recent quarterly earnings strategies as a margin retention measure. In addition, in a typical delivery AO/IO/BPO pyramid, 75%-80% of the resources are in these bottom two rungs wherein the compensation is being held steady. So, the talent war and the heated 20%-40% wage hikes for experienced hires only applies to 20%-25% of the wage pyramid i.e., 4%-10% net wage increase on a blended wage pyramid. However, wage / compensation is ~50% of a fully loaded offshore rate card (other components being real-estate, telecom/technology, consumables, SG&A, op-margins), therefore, the net offshore rate card impact of blended wage increase is halved to 2%-5%. Now, offshore is typically 80%-90% of the offshore-onshore managed services delivery. Therefore, the net service delivery impact of COLA in a global managed services contract is 2.5%-4.5% and with this rationale we manage to close the agreement at 3.0-3.5% global COLA on equitable and transparent footing.